Recently, I had a few clients asking about the distinction between qualified and nonqualified written notice of allocation. Tax season being right around the corner, it feels like a good opportunity to talk about those.

The USDA has some wonderful material[1] explaining the definition and use of both notices of allocation, this post and the next will summarize some of it. Although they are quite easy to read, it is true that those concepts might not make sense until a cooperative actually has to allocate patronage. However, I think this is one of those concepts that differentiates a cooperative from a traditional business. This is about how you “pay” patronage dividends to your cooperative members. To better absorb these concepts, I’ll break the topic into two posts and will start with a definition of patronage dividends.

Patronage dividends defined.

The concept of patronage is an integral part of the concept of cooperative[2]. The Internal Revenue Service puts it this way: “Cooperatives are required to allocate their net margins from business done with or for their patrons back to their patrons in proportion to their patronage. This return of “patronage-sourced income”[3] is bound up with the basic concept of a cooperative,” which is that of “operating on a cooperative basis.” It is also the reason why some cooperatives refer to the return of income as a “refund” rather than as a dividend.

Subchapter T of the Internal Revenue Code (IRC 1.1381.1), which governs the corporate cooperative income tax treatment, recognizes that the objective of business conducted on a cooperative basis is not to generate profit for the cooperative, but to pass through that net income to the members. Therefore, the Code conditions the use of a cooperative-specific tax treatment, known as single tax treatment, to the cooperative paying or allocating member returns based on patronage.[4]

Cooperatives distribute member-based net income to patrons in the form of patronage dividends or refunds. Patronage dividends are net margins[5] distributed to members according to their patronage (or “use”) of the cooperative. The basic tax principle here is that net profits are considered an overcharge in a cooperative and should therefore be returned to patrons.

Subchapter T[6] lays out three basic criteria for amounts paid to a member-patron to be classified patronage dividends:

- “on the basis of quantity or value of business done with or for such patron,”

- “under an obligation of such organization to pay such amount, which obligation existed before the organization received the amount paid,” and

- “which is determined by reference to the net earnings of the organization from business done with or for its patrons.”

Item 1 requires the cooperative to specify the basis for calculating patronage. The patronage dividend must be proportionally allocated based on business done with patron including non-members.

Item 2 requires that the cooperative operate under a pre-existing obligation to pay patronage dividends. This is normally part of the bylaws but may also be in the form of a written agreement with the members. State law normally allows a board to determine that some or all of income be set aside as a reserve not to be paid out as patronage. Patronage dividends are not allowed if there was not an obligation established at the beginning of the tax year from which patronage is paid. Part of establishing the obligation is informing members that they may receive a patronage dividend. This is one reason cooperatives should distribute their bylaws to new members and obtain written consent from members to report patronage dividends on their individual tax returns. These consents typically appear in a membership agreement, the contract that binds and governs the relationship between member and cooperative, and subjects the member to the governance structure of the cooperative’s bylaws.

Item 3 specifies that the basis for patronage dividends is “patron-sourced” income. Simply put, if you buy at the local grocery co-op, what you pay for the purchases counts as patron-sourced income[7]. The IRS prefers taxable income as the patronage basis. This is what most cooperatives use, although book income[8] may also be used. The basis for determining patronage dividends should be used consistently and should be specified in the bylaws. “Patron-source” income will be the subject of another blog post, so stay tuned.

It is important to note that the definition of patronage dividend brings a subtle fourth requirement: the payment must be made to patrons.[9] While the Code does not define patron, the applicable regulation defines a patron as “any person with or for whom the cooperative association does business on a cooperative basis, whether a member or a non-member of the cooperative.”[10] A patron is anyone who has a legal right to share in the cooperative’s margins on a pro rata patronage basis. A cooperative may choose to only do business with members on a patronage basis, or it may treat both members and nonmembers as patrons. An example would be an agricultural cooperative where the farmers are members, but persons in the community purchase goods or services from the cooperative. Both would be considered patrons, although only the farmers would be called members. A person who deals with the cooperative but receives no refund (patronage dividends) is not a patron. These definitions are all laid out in the cooperative’s bylaws. Note that many cooperatives choose to only pay patronage dividends to their members, so non-member patronage must be allocated to indivisible reserves, or retained earnings, on an after-corporate tax basis.

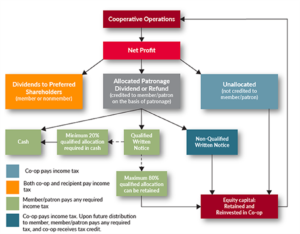

Here’s a visual of cooperative distributions to patrons and their respective treatment:

Patronage dividends represent a unique opportunity for cooperatives to manage their cash flow and avoid taxation at the cooperative level on some of the cooperative’s earnings.

“Qualified” or “non-qualified” written notices are a matter of tax law. Subchapter T not only defines patronage dividends, but it also establishes a single tax principle. This principle places the tax burden of patronage dividends on the final recipient and not the cooperative.

For allocated patronage dividends to be “tax-free” for the cooperative, and taxable only at the member level, they must be paid in money or property, or through a document called a qualified written notice of allocation. Otherwise, the co-op may be responsible for paying the taxes on the cooperative’s net income, and the amounts may even be subject to double taxation. Come back in a couple of weeks and I’ll tell you more about how it all works.

[1] See e.g. https://www.rd.usda.gov/sites/default/files/cir44-3.pdf, https://www.rd.usda.gov/sites/default/files/cir9.pdf, https://www.rd.usda.gov/sites/default/files/cir23.pdf

[2] IRS 201945011. See CF Industries, Inc. v. Commissioners, 995 F.2d 101, 103 (7th Cir. 1993). https://www.irs.gov/pub/irs-wd/201945011.pdf

[3] See Linnton Plywood Ass’n v. United States, 410 F.Supp. 1100 (D.C. Ore. 1976); Cotter and Co. v. United States, 765 F.2d 1102 (Fed. Cir. 1985); St. Louis Bank for Cooperatives v. United States, 624 F.2d 1041, 224 Ct.Cl. 289 (1980); Mississippi Valley Portland Cement Co. v. United States, 408 F.2d 827, 832 (5th Cir.), cert. denied, 395 U.S. 844, 89 S.Ct. 2015, 24 L.Ed.2d 462 (1969); Land O’Lakes, Inc. v. United States, 675 F.2D 988 (8th Cir.1982). Note that even though the concept is known as “patron-source income,” it is often applied as member-source income, because most co-ops limit dividends to members. The non-member patron income will be subject to corporate income tax and allocated to retained earnings, or indivisible reserves.

[4] From a tax perspective, the court has decided that the principal difference between the cooperative form of doing business and the ordinary corporate form is that the shareholders of a cooperative share in the cooperative’s income in proportion to their purchases from the cooperative rather than to the number of shares they own.” CF Industries, Inc., v. Commissioner, 995 F.2d 101 (7th Cir. 1993).

[5] Revenue less expenses equals net profit or earnings or net margins.

[6] 26 U.S. Code, Section 1388 (a).

[7] On the other end of the spectrum, if the cooperative sells some piece of equipment they no longer need, that income is not a patron-sourced income – selling equipment is not part of the co-op business activity, selling inventory to patrons is.

[8] Book income is the amounts that are published by companies via their financial statements, not necessarily based on what the company has in the bank – for example, think about the impacts of income based on accrual method. That’s going to count toward the book income.

[9] IRC Section 1388 (a) and Treas. Reg. Section 1.1388-1(a)(1).

[10] Treas. Reg. Section 1.1388-1(e).